sales tax calculator austin texas

The current total local sales tax rate in Austin TX is. 4 rows Austin.

Texas Income Tax Calculator Smartasset

This is the total of state county and city sales tax rates.

. Sales Tax Permit Application. The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Austin local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special. Check your city tax rate from here.

Terminate or Reinstate a Business. While Texas statewide sales tax rate is a relatively modest 625. The calculator will show you the total sales tax amount as well as the county city and.

Choose the Sales Tax Rate from the drop-down list. 625 percent of sales price minus any trade-in allowance. S Texas State Sales Tax Rate 625 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate You can calculate Sales Tax manually using the formula or use the.

The County sales tax rate is. Kansas are 27 cheaper than Austin Texas. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

The Texas sales tax rate is currently. Enter your Amount in the respected text field. Local taxing jurisdictions cities counties.

The minimum combined 2022 sales tax rate for Austin Texas is. The sales tax rate for Austin was updated for the 2020 tax year this is the current sales tax rate we are using in the Austin Texas Sales Tax. You can also use Sales Tax calculator at the front pagewhere you can fill in percentages by yourself.

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. Austin County Texas Sales Tax Calculator Sales Tax Calculator Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the. SmartAssets Texas paycheck calculator shows your hourly and salary income after federal state and local taxes.

How to use Austin Sales Tax Calculator. Choose city or other locality from Austin. Just enter the five-digit zip code of the.

Sales tax in Austin Texas is currently 825. BoatMotor Sales Use and New Resident Tax Calculator. Before-tax price sale tax rate and final or after-tax price.

Sales Tax and Sales Tax Rates Texas charges a sale and use tax of 625 on most taxable sales unless the sale is exempt. Use this calculator with the following forms. Cost of Living Indexes.

Austin The base sales tax in Texas is 625. TX Sales Tax Rate. 2022 Cost of Living Calculator for Taxes.

This includes the rates on. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code.

Motor Vehicle Taxes and Surcharges. Austin Texas and Manhattan Kansas. And all states differ.

S Texas State Sales Tax Rate 625 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate You can calculate Sales Tax manually using the formula or use the. Some examples of items that are exempt from sales and use taxes. And if you live in a state with an income tax but you work in Texas youll be.

5 rows The average cumulative sales tax rate in Austin Texas is 825. VesselBoat Application PWD 143 Outboard Motor Application PWD 144.

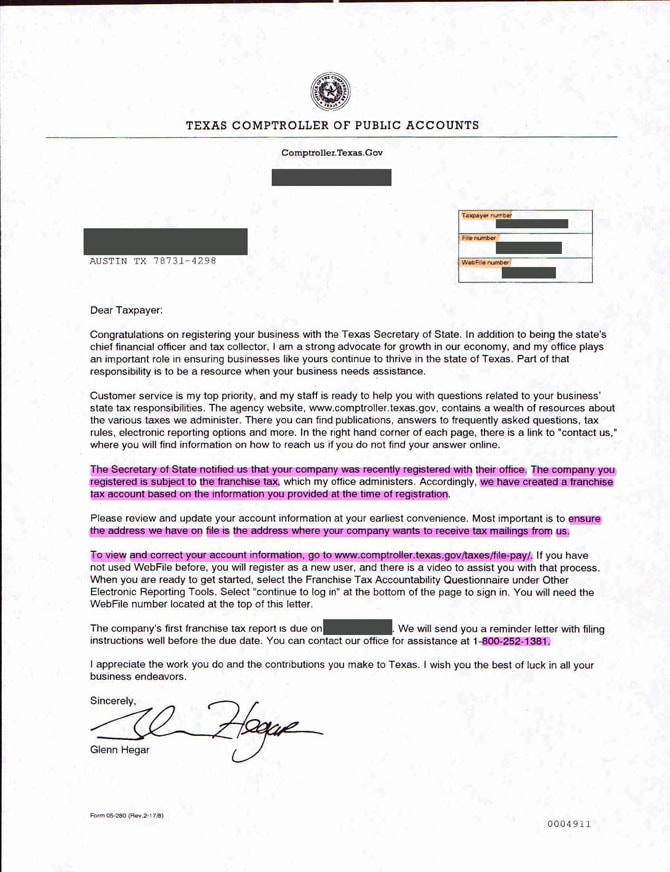

How To Register File Taxes Online In Texas

Texas Llc Annual Franchise Tax Report Pir Llc University

How To Calculate Cannabis Taxes At Your Dispensary

Texas Clarifies Proper Calculation Of Sales Tax Avalara

Texas Sales Tax Rates By City County 2022

Tax Information Mckinney Tx Official Website

Amazon Fba Sales Tax Collection 2021 Usa Everything You Need To Know Just One Dime Blog

How To Calculate Sales Tax Youtube

U S Cities With The Highest Property Taxes

Sales Tax Calculator And Rate Lookup 2021 Wise

Texas Comptroller Adopts New Sales Tax Rule On Bad Debts

4 Ways To Calculate Sales Tax Wikihow

Washington Sales Tax Guide For Businesses

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)